South Carolina Solar Tax Bill

You can enjoy a 25 state tax credit if you buy your own solar system.

South carolina solar tax bill. Solar panel tax credits in south carolina. Solar sc gov is south carolina s source for solar information. We will help guide you through the process of switching to solar and producing your own energy educate you on how solar energy works and will be with you every step of the. 44 which now moves on to the state s house of representatives would allow residential solar owners to receive an 80 property tax abatement following the installation of a qualifying.

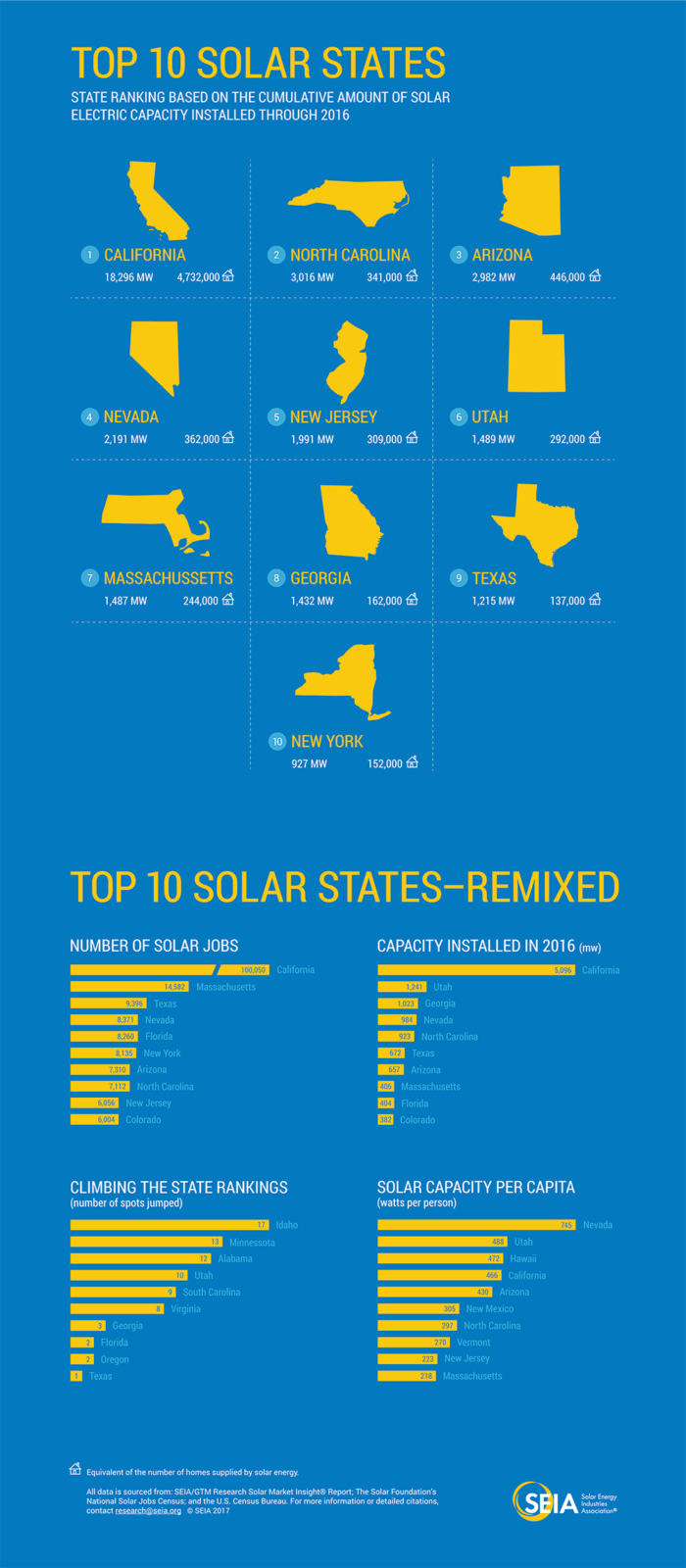

South carolina s senate moved last week to make solar installations more attractive to businesses by providing property tax breaks for installations. South carolina s tax credits may be earned by individuals c corporations s corporations partnerships sole proprietors and limited liability companies. But there are other ways to save that don t involve taxes when you go solar in south carolina. The renewable energy economic development b ill s.

Can only take 3 500 or 50 of your tax liability per year for up to 10 years. South carolina has one of the most generous solar tax credits in the region. The bill allows a taxpayer who constructs purchases or leases solar energy property to claim an income tax credit equal to 25 percent of the cost including the cost of installation. The south carolina legislature on thursday unanimously passed the energy freedom act a comprehensive solar bill that will lift the state s 2 cap on net metering among many other pro solar actions.

Still solar can help with south carolina s sky high electric bills and the state s solar tax credit is among the best in the nation. With the federal solar tax credit already reduced from 30 to 26 percent there s never been a better time to go solar in the palmetto state. South carolina law encourage s the development and use of indigenous renewable energy resources renewable energy which includes biomass wind solar hydropower geothermal and hydrogen derived from renewable sources can mitigate south carolina s dependence on imported energy and help meet state air quality goals. However purchasing a solar system or signing a 20 year lease for solar panels is like buying a car you need to do your homework check prices from several sources and think carefully about.

A tax credit is an amount of money that can be used to offset your tax liability. 25 of total system cost up to 35 000. Solar panels allow you to generate clean energy and can save you money. Credits are usually used to offset corporate income tax or individual income tax.